We help loan officers

grow their impact.

Empower LO is a marketing firm specializing in helping mortgage companies and their individual loan officers leverage the power of Go HighLevel to transform their marketing and borrower communication.

What can we help with?

HighLevel for

Loan Officers

Ready to get serious about marketing your mortgage business? We've got the expertise and the technology you need to use the HighLevel platform to grow your business.

Mortgage

Leads

Empower LO offers exclusive purchase leads and everything

you need to convert

them! Driven by 100% Google search traffic, 8 of 10 leads generated haven't met a realtor, giving you an edge.

myAgent

Classes

Educate your market's realtors with ready-made classes and all of the follow up you probably won't do without our help! Our platform creates connections that turn into lasting relationships.

Not sure what you need? We can help with that too!

We help loan officers

grow their impact.

Empower LO is a marketing firm specializing in helping mortgage companies and their individual loan officers leverage the power of Go HighLevel to transform their marketing and borrower communication.

What can we help with?

HighLevel for Loan Officers

Balancing growth and deals? Let our

LO-designed software simplify

tasks and provide marketing insights.

Mortgage Leads

Empower LO offers exclusive

purchase leads and everything you

need to convert them! 80% haven't

met a realtor, giving you an edge.

myAgent Classes

Educate your market's realtors

with ready-made classes.

Our platform creates

lasting agent connections.

Not sure what you need?

We can help with that too!

$7,500,000

Commissions earned through

Empower LO marketing campaigns.

Trusted by top producers

from companies like yours.

Only the best: 5-star feedback from Google Reviews.

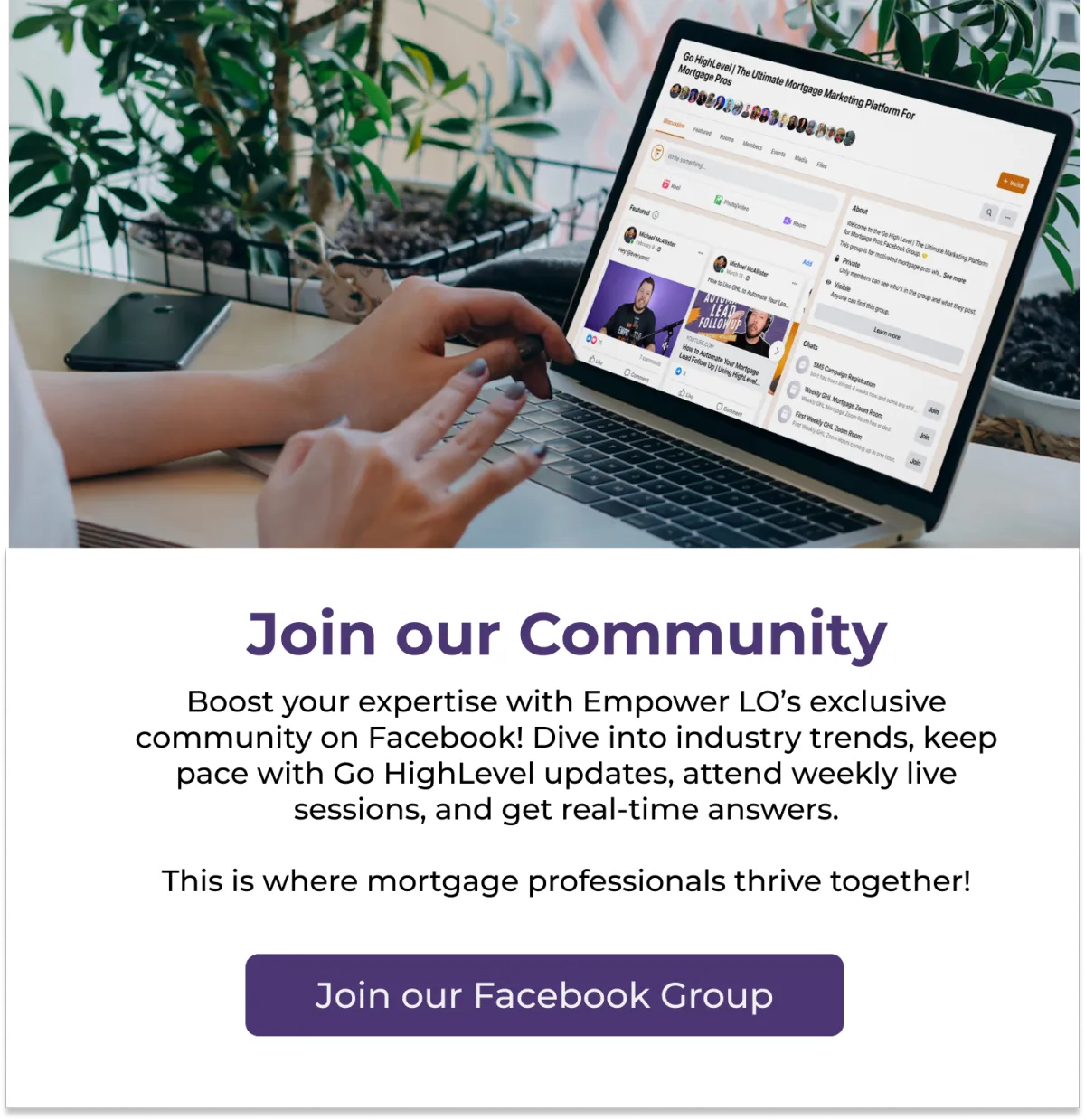

Explore More.

500+

Loan officers using Empower LO's

mortgage marketing platform.

Frequently Asked Questions

What is Empower LO? Is it a CRM?

Great question! Empower LO is more than just a CRM or a HighLevel white-label. We're a marketing firm based in Boise, ID, dedicated to helping loan officers grow their business. While we do utilize HighLevel's powerful platform and offer a customized version for loan officers, our true value lies in our specialized industry expertise and community-focused approach. We provide a comprehensive suite of services tailored to the unique needs of the mortgage industry. Think of us as your growth partner, not just a software provider.

Does Empower LO sell mortgage leads?

Not technically. Although one of the services Empower LO offers involves generating leads using Google Ads, we do this by representing you as an agency, not by selling you leads. This means you get access to 100% of the traffic/leads generated by the pages we build for you, and that data doesn't have the potential to be sold to anyone else. In addition, we advertise YOU, not our own brand.

Why should I use your version of HighLevel?

Our version of HighLevel is tailored specifically for loan officers who are looking to grow their business. Not only that, but with it you gain access to support and coaching from our team of in house experts. We offer options for those who want to signup with HighLevel directly as an agency as well! Book your strategy call to learn more.

What if I'm not very tech-savvy? Can Empower LO still help me?

If you're not very tech-savvy, but you know the benefits of the HighLevel platform will help you get where you want to go with your business, then we are the perfect partner for you. Empower LO has been helping loan officers bridge the gap between them and cutting-edge marketing practices and technology since 2018. We tailor our advice and coaching to your experience level, so you never feel left behind.

How much does Empower LO cost?

It depends! What are your production goals? How quickly are you trying to reach them? What's your budget? Empower LO has services starting at $297/mo, but has a suite of options depending on what's right for your individual situation. Book your free strategy call today to learn more about our services and how we can help scale your business in any market condition.

Anything you'd like to ask?

Not seeing your question answered above? Reach out now to speak to one of our expert team members.

1000+

Loan officers assisted with marketing campaigns and automation

$130,000+

Total monthly ad spend

managed by Empower LO

350,000+

Purchase leads generated

by Empower LO clients

$7,500,000+

Commissions earned by

Empower LO clients

Only the best: 5-star feedback from Google Reviews.

Trusted by top producers from companies like yours.

Frequently Asked Questions

Anything you'd like to ask?

Not seeing your question here?

Reach out to one of our expert team

members during business hours.

What is Empower LO? Is it a CRM?

Great question! Empower LO is more than just a CRM or a HighLevel white-label. We're a marketing firm based in Boise, ID, dedicated to helping loan officers grow their business. While we do utilize HighLevel's powerful platform and offer a customized version for loan officers, our true value lies in our specialized industry expertise and community-focused approach. We provide a comprehensive suite of services tailored to the unique needs of the mortgage industry. Think of us as your growth partner, not just a software provider.

Does Empower LO sell mortgage leads?

Not technically. Although one of the services Empower LO offers involves generating leads using Google Ads, we do this by representing you as an agency, not by selling you leads. This means you get access to 100% of the traffic/leads generated by the pages we build for you, and that data doesn't have the potential to be sold to anyone else. In addition, we advertise YOU, not our own brand.

Why should I use your version of HighLevel?

Our version of HighLevel is tailored specifically for loan officers who are looking to grow their business. Not only that, but with it you gain access to support and coaching from our team of in house experts. We offer options for those who want to signup with HighLevel directly as an agency as well! Book your strategy call to learn more.

What if I'm not very tech-savvy? Can Empower LO still help me?

If you're not very tech-savvy, but you know the benefits of the HighLevel platform will help you get where you want to go with your business, then we are the perfect partner for you. Empower LO has been helping loan officers bridge the gap between them and cutting-edge marketing practices and technology since 2018. We tailor our advice and coaching to your experience level, so you never feel left behind.

How much does Empower LO cost?

It depends! What are your production goals? How quickly are you trying to reach them? What's your budget? Empower LO has services starting at $297/mo, but has a suite of options depending on what's right for your individual situation. Book your free strategy call today to learn more about our services and how we can help scale your business in any market condition.